- Contact

- About

- Services

- Blog

- Login

- Menu×

Property prices soar to new heights in April 2024

02 May 2024 |3 Minutes Read

Australia's housing market has entered its 16th consecutive month of growth, with national prices hitting a record high in April.

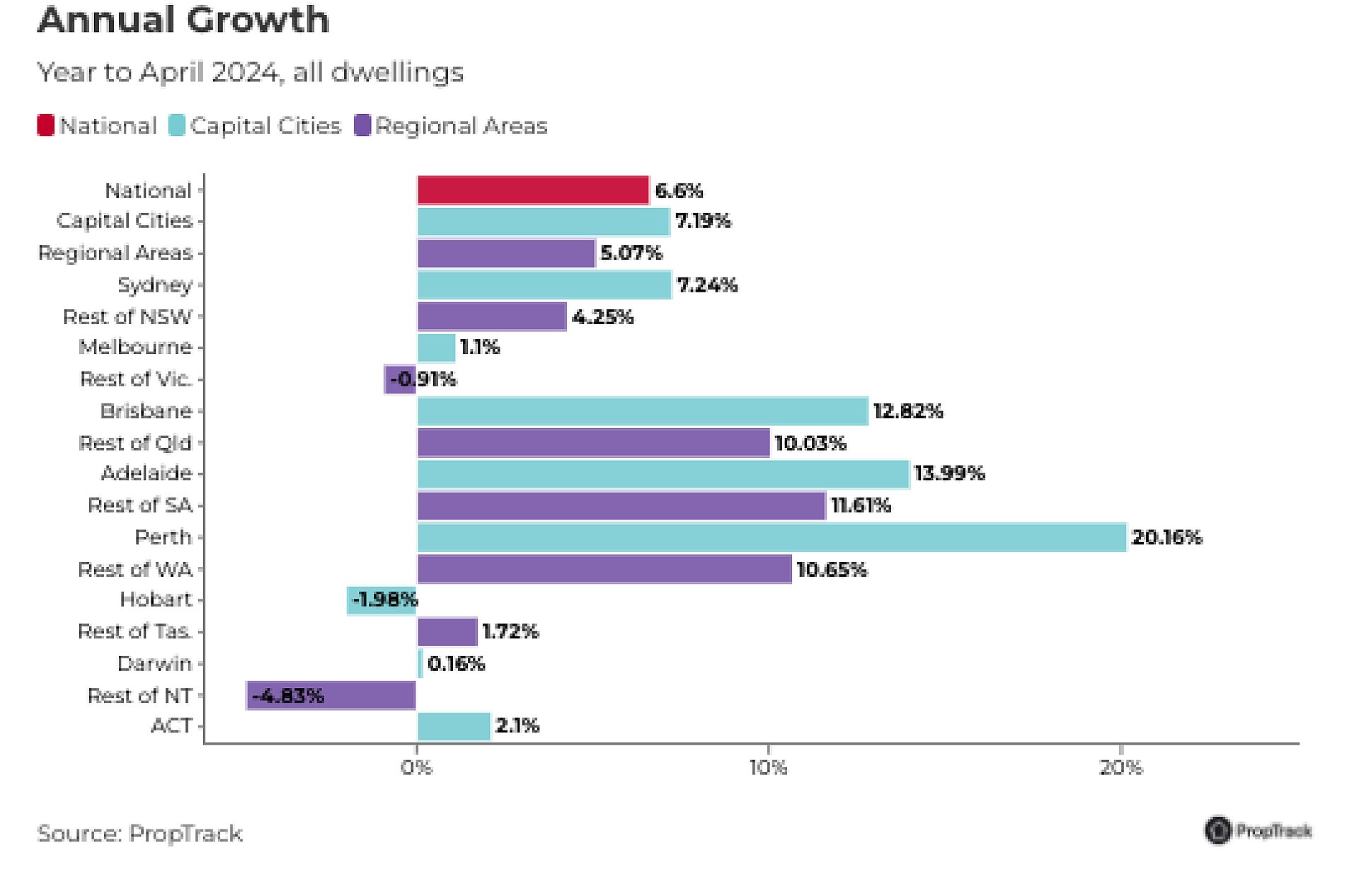

Despite the challenges posed by higher interest rates and affordability constraints, the PropTrack Home Price Index reveals that prices have risen by an impressive 6.60% compared to April 2023 levels.

The driving forces behind this sustained growth are multifaceted. Strong population growth, tight rental markets, low unemployment rates, and substantial home equity gains have collectively stimulated housing demand. However, the supply side of the equation has struggled to keep pace, with building activity languishing at decade-low levels, further exacerbating the housing supply shortage.

This stark imbalance between supply and demand has proven to be a formidable force, offsetting the impact of the higher interest rate environment and affordability challenges. As a result, home prices continue to climb steadily.

Capital Cities Lead the Charge

The combined capital cities have been at the forefront of this price growth, with prices rising 0.21% to reach a new peak in April. Capital city prices now sit 7.19% above levels from the same time last year. However, the performance has been far from uniform across the capitals.

Perth and Adelaide have emerged as the strongest performers, recording the fastest monthly growth in April at 0.83% and 0.55%, respectively. Perth, in particular, has seen a staggering 20.16% price increase over the past year, while Adelaide has witnessed a robust 13.99% growth.

Brisbane follows closely behind, securing its position as the third strongest market over the past year. Home prices in Brisbane have surged 12.82% above April 2023 levels, propelling the city's median value to $818,000. This remarkable growth has seen Brisbane surpass Melbourne for the first time in 14 years.

Melbourne and Hobart, on the other hand, have experienced slight price declines of 0.10% and 0.24%, respectively, in April. However, Melbourne remains 1.10% above year-on-year levels, while Hobart's prices are still 35.4% higher than in March 2020, despite a recent slowdown.

Regional Markets Make Their Mark

While capital cities have outpaced regional areas over the past year, regional markets have made a strong showing in April. Regional areas lifted 0.30% to reach a new peak, outperforming the combined capitals' growth of 0.21%. Regional NSW (+0.50%), regional WA (+0.33%), and regional Queensland (0.30%) led the charge in April.

Unit Market Shines

The unit market has started 2024 on a strong footing, with prices growing 0.29% in April, compared to a 0.22% increase for detached houses. This growth brings unit prices up 2.21% year-to-date, slightly outpacing house prices at 1.92%.

The relative affordability of apartments, coupled with strong demand for inner-city living post-pandemic and housing supply constraints, has buoyed buyer demand and pricing in the apartment market.

Prices Expected to Rise Further

Despite the challenges posed by higher interest rates, inflation, and a decelerating economy, the Australian housing market is expected to maintain its upward trajectory in the months ahead. The stable interest rate environment has instilled confidence among buyers and sellers, and the persistent mismatch between supply and demand is likely to continue fuelling price rises.

Although the pace of growth may slow as the quieter winter period approaches and rate cut expectations are pushed further out, the smaller capital city markets of Perth, Adelaide, and Brisbane are poised to maintain their outperformance. Very low stock levels in these cities are intensifying competition amid strong buyer demand, creating a sellers' market.

Delete alertGet property alerts

Get email alerts as soon as properties matching these criteria become available.

$$Send alerts to:

Create an account or login to add properties to wishlist

Create an account or login to add properties to a wishlist. Sign up for property email alerts as soon as properties matching your search criteria become available.

Already have an account? Login here.

Sign up with Facebook Sign up with GoogleOrCreate an account or login to create property alerts

Create an account or login to add properties to a wishlist. Sign up for property email alerts as soon as properties matching your search criteria become available.

Already have an account? Login here.

Sign up with Facebook Sign up with GoogleOr