- Contact

- About

- Services

- Blog

- Login

- Menu×Market Insights

Australian property market continues to soar: Insights from March 2024

02 April 2024 |6 Minutes Read

The Aussie property market shows remarkable strength & resilience, defying high-interest rates & cost of living pressures.

In this article, we'll take an in-depth look at the latest data from CoreLogic and realestate.com.au's PropTrack Home Price Index, which both reveal that national home prices have reached new record highs in March 2024.

We'll explore the key drivers behind this growth, examine the performance of capital cities and regional markets, and discuss the potential implications for buyers, sellers, and investors.

National home values reach new records

According to the latest data from CoreLogic, the national home value index rose 0.6% in March 2024, marking the 14th consecutive month of growth. This impressive streak has resulted in a 10.2% increase in national home values since January 2023, adding approximately $71,832 to the median dwelling value. This growth is particularly noteworthy given the headwinds of high-interest rates and cost of living pressures that have impacted household budgets.

Several factors have contributed to this ongoing strength in the property market.

Firstly, there is a persistent imbalance between housing supply and demand, with the number of new dwellings being completed falling short of the growing population's needs.

Secondly, Australia's population growth has been rapid, with the year ending September 2023 seeing a 2.5% increase – the fastest pace since the commencement of the ABS national population series in 1981. This growth translates to approximately 659,800 new residents requiring housing, placing significant pressure on the market.

Capital cities: A mixed bag of growth

While the national picture is one of growth, the performance of individual capital cities has been more varied. Perth led the pack in March 2024, with an impressive 1.9% increase in dwelling values over the month of March. This growth can be attributed to several factors, including the relative affordability of Perth's housing compared to other capital cities, strong demand from both interstate and overseas migrants, and a persistent undersupply of housing.

Adelaide and Brisbane also experienced strong growth, with dwelling values rising 1.4% and 1.1%, respectively month on month. These cities have benefited from their relative affordability compared to Sydney and Melbourne, as well as strong demand from interstate migrants seeking a more balanced lifestyle.

Melbourne, on the other hand, was the only capital city to record a negative quarterly movement, with values down -0.2% in the first three months of the year. This can be attributed to a combination of factors, including the city's extended lockdowns during the pandemic, which impacted consumer confidence and economic activity, as well as a more significant supply of housing relative to demand.

Sydney, Australia's largest housing market, experienced a more moderate 0.3% increase in dwelling values over the month. While this growth is slower than some of the other capital cities, it is still a positive sign for the market, given the city's high median dwelling values and the significant impact of interest rate rises on borrowing capacities.

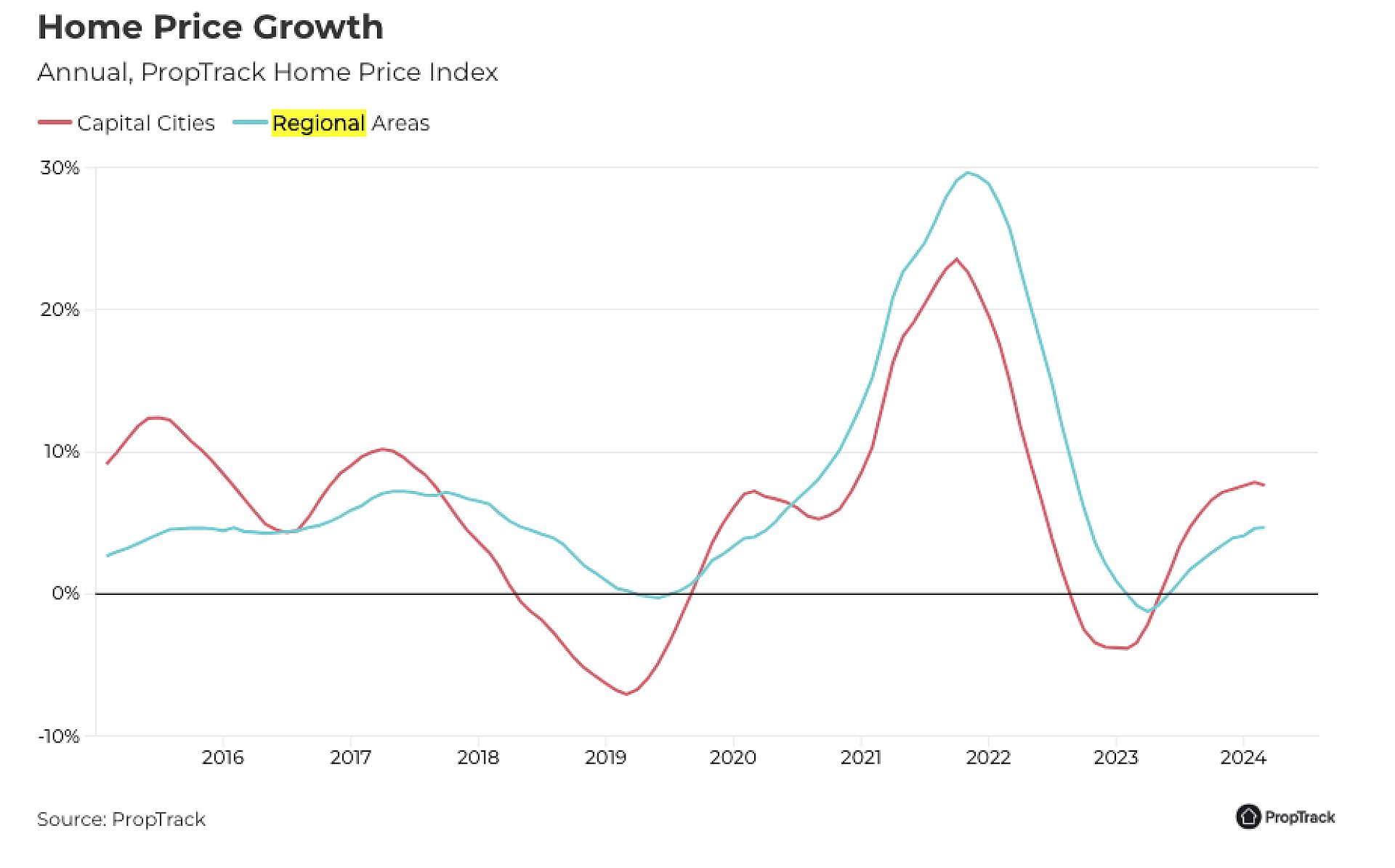

Regional Markets: A Tale of Two Speeds

Prices in capital cities have outpaced regional areas this year to date. Even so, regional areas lifted 0.19% in March to a new peak, with regional South Australia (up 0.64%) and Queensland (up 0.49%) leading the charge. These markets have benefited from the ongoing trend of sea and tree-changers seeking a more affordable and relaxed lifestyle outside of the capital cities. However, regional Victoria bucked the trend, with values declining -0.3% in the first quarter of the year.

Buyer demand remains resilient, supporting property prices

Even though there have been challenges posed by high-interest rates and cost of living pressures, buyer demand in the Australian property market has remained remarkably resilient. This sustained demand has played a crucial role in supporting property prices and driving the market's ongoing growth, despite the increase in new listings hitting the market.

Several factors have contributed to this resilience, including the expectation that interest rates may begin to move lower in the latter half of 2024, which has boosted buyer confidence.

Additionally, the rapid pace of population growth, fuelled by strong interstate and overseas migration, has increased the pool of potential buyers and put upward pressure on prices.

The tight rental markets across the country have also incentivized many renters to consider purchasing a property, as they seek to escape rising rental costs and secure more stable housing arrangements.

Furthermore, the significant home equity gains experienced by many existing homeowners have provided them with the financial flexibility to upgrade or invest in additional properties, further bolstering demand.

As a result, even in the face of economic uncertainty and affordability challenges, buyer demand has remained a key pillar of support for the Australian property market, helping to maintain the strong price growth seen in recent months.

Rental markets remain tight

One of the most significant challenges facing the Australian property market is the ongoing tightness in rental markets. The national rental index rose 2.8% in the March quarter, the fastest pace of rental growth since May 2022. This growth is being driven by a combination of factors, including the rapid pace of population growth, which is increasing demand for rental properties, as well as the ongoing undersupply of housing.

Interestingly, unit rents are rising faster than house rents across the combined capitals, with unit rents up 2.9% in the March quarter compared to 2.7% for houses. This trend may reflect the increasing demand for more affordable housing options, particularly in the face of rising interest rates and cost of living pressures.

Affordability concerns persist

Despite the strong performance of the property market, housing affordability remains a significant concern for many Australians. With home values, rental rates, and the cost of servicing a mortgage rising faster than household incomes, many potential buyers are finding it increasingly difficult to enter the market.

This is particularly true for first home buyers, who often lack the significant deposit required to purchase a property in the current market. However, there are some signs that the relative affordability of units compared to houses may provide an opportunity for these buyers to enter the market.

Looking ahead: Navigating uncertainty

As we move further into 2024, the outlook for the Australian property market remains positive, albeit with some uncertainty. The expectation that interest rates may begin to move lower in the latter half of the year is likely to provide a boost to buyer and seller confidence, as well as borrowing capacities.

However, the market will need to navigate a range of challenges, including the ongoing imbalance between housing supply and demand, the impact of rising construction costs and labour shortages on new housing supply, and the potential for economic conditions to deteriorate in the face of global uncertainty.

For those considering buying, selling, or investing in property, it is essential to stay informed about market trends and to work with experienced real estate professionals who can provide guidance and support. By understanding the key drivers of the market and the potential risks and opportunities, you can make informed decisions that align with their financial goals and personal circumstances.

Delete alertGet property alerts

Get email alerts as soon as properties matching these criteria become available.

$$Send alerts to:

Create an account or login to add properties to wishlist

Create an account or login to add properties to a wishlist. Sign up for property email alerts as soon as properties matching your search criteria become available.

Already have an account? Login here.

Sign up with Facebook Sign up with GoogleOrCreate an account or login to create property alerts

Create an account or login to add properties to a wishlist. Sign up for property email alerts as soon as properties matching your search criteria become available.

Already have an account? Login here.

Sign up with Facebook Sign up with GoogleOr